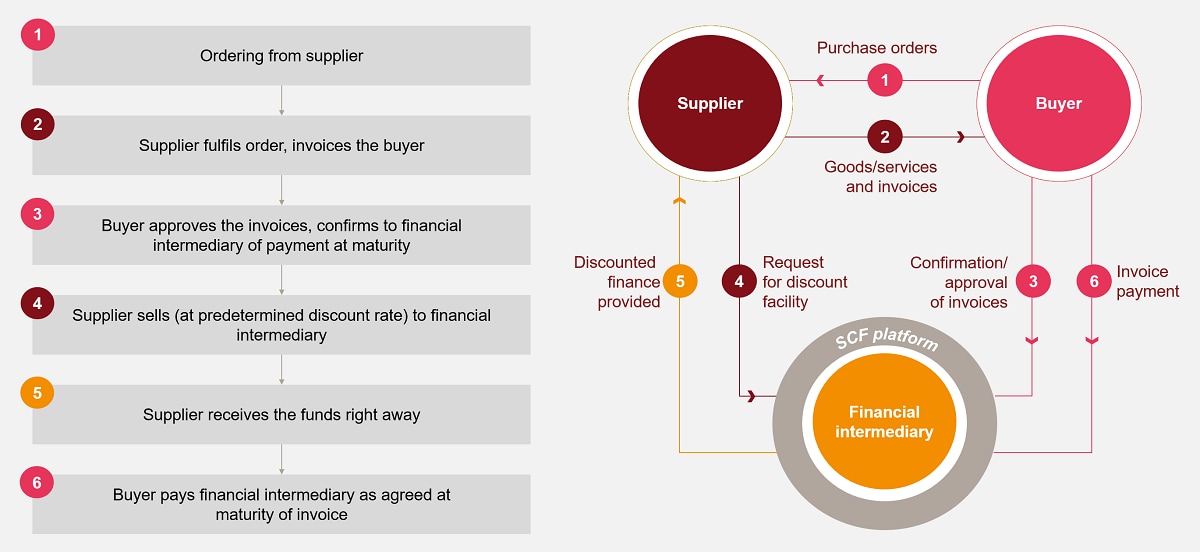

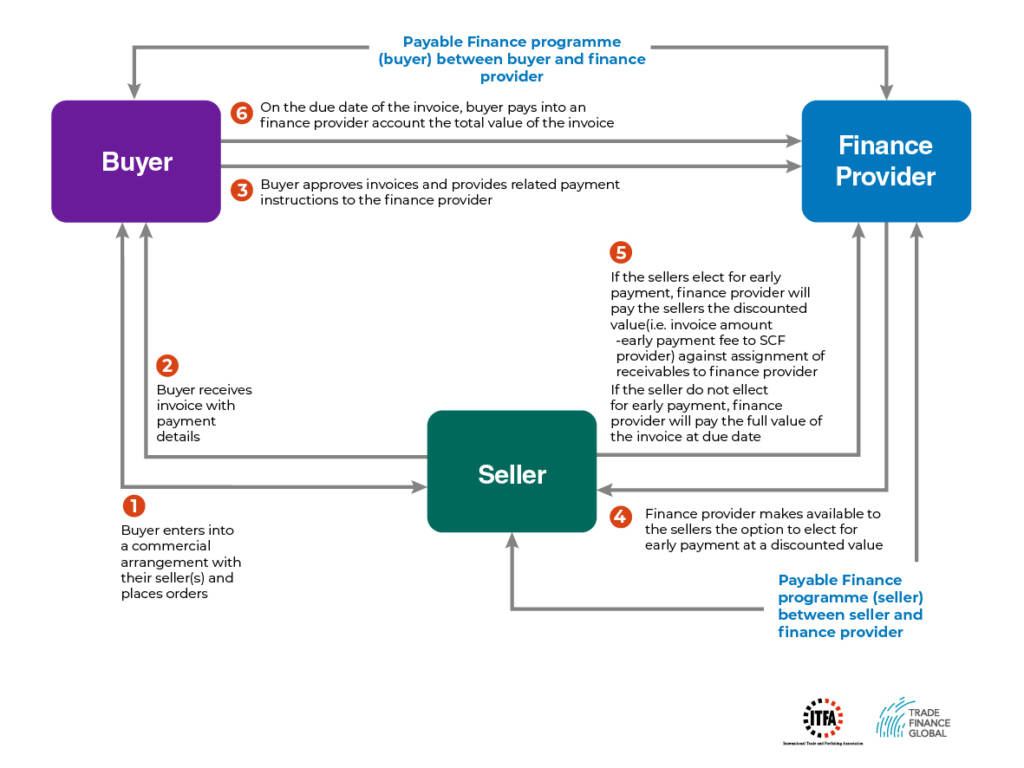

There are several variations on the supply chain finance model but the basic idea is that suppliers sell their receivables to banks or other financial service providers which are often called factors.

Supply chain finance definition.

Supply chain finance scf is a term describing a set of technology based solutions that aim to lower financing costs and improve business efficiency for buyers and sellers linked in a sales.

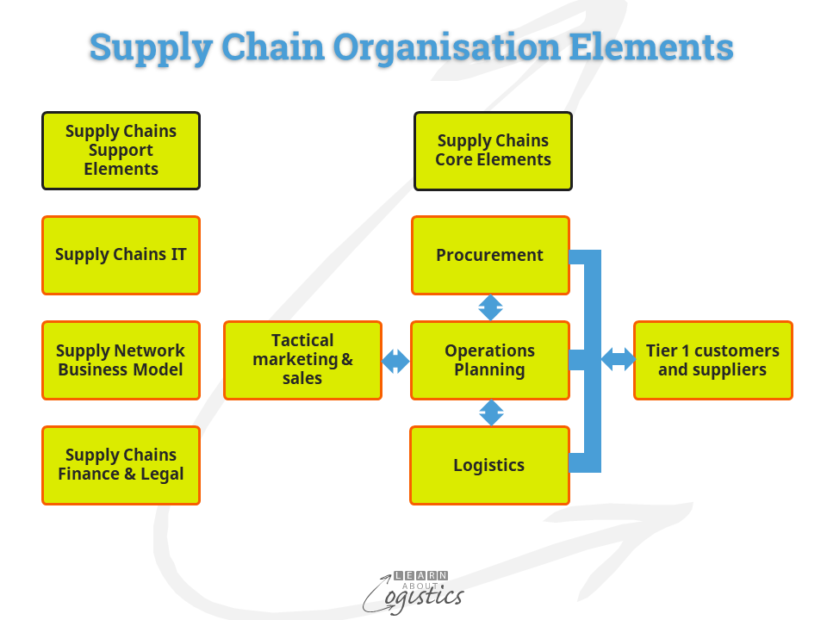

A typical service offering from a bank will include.

This results in a win win situation for the buyer and supplier.

What is supply chain finance.

Unlike traditional factoring where a supplier wants to finance its receivables supply chain financing is a financing method initiated by the ordering party in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offered.

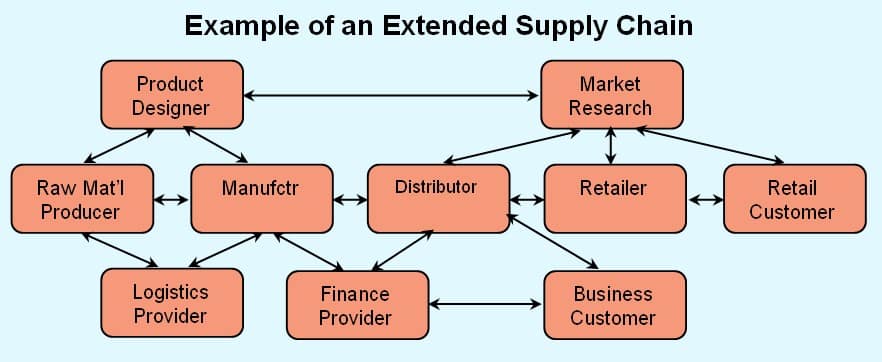

Supply chain finance is a set of technology enabled business and financial processes that provides flexible payment options for a buyer such as a manufacturer or retailer and one of their suppliers for example a raw materials or inventory supplier typically through the services of a financial institution at lower financing costs.

Whereas the financial supply chain is the flow of money from the customer back up the chain to the supplier.

Während das supply chain management im eigentlichen sinn und damit insbesondere das logistikmanagement vor allem für die logistischen prozesse und deren optimierung hinsichtlich zeit kosten und service qualität verantwortlich ist geht es bei supply chain.

Supply chain finance has the potential to increase cash flow and liquidity in international trade.

Supply chain finance ist die unternehmensübergreifende optimierung von finanzstrukturen und finanzflüssen zur maximierung der rentabilität einzelner oder mehrerer unternehmen einer lieferkette englisch supply chain.

Building on what we have termed as traditional trade finance there are a number of ways in which banks can help corporate clients trade both domestically and cross border for a fee.

Supply chain finance also known as supplier finance or reverse factoring is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and sme suppliers to get paid early.